Find the best LLC service for you and your new business entity.

New and experienced entrepreneurs have found online LLC formation services a boon. Formation worries can be solved by letting experts manage your entire LLC formation process.

We compared 7 of the most popular LLC formation companies based on their pricing, completion times, support levels, plan options, and other key factors.

Our 7 Picks for Best LLC Services for 2023

- Northwest Registered Agent

- Incfile

- ZenBusiness

- Swyft Filings

- Rocket Lawyer

- Inc Authority

- BetterLegal

Pricing Table for the 7 Best LLC Services and their Popular Plans

| Service | LLC Formation with One Year of Registered Agent Service |

|---|---|

| Northwest Registered Agent | Discounted price for our readers! |

| Incfile | $149 |

| ZenBusiness | $299 |

| Swyft Filings | $299 |

| Rocket Lawyer | $250 |

| Inc Authority | $389 |

| BetterLegal | $389 |

“Free” does not always mean free.

Ask the “free formation” service if they sell your private information.

Northwest Registered Agent is ‘Privacy by Default’

The Top 7 LLC Formation Services (Brief Summaries)

1. Northwest Registered Agent

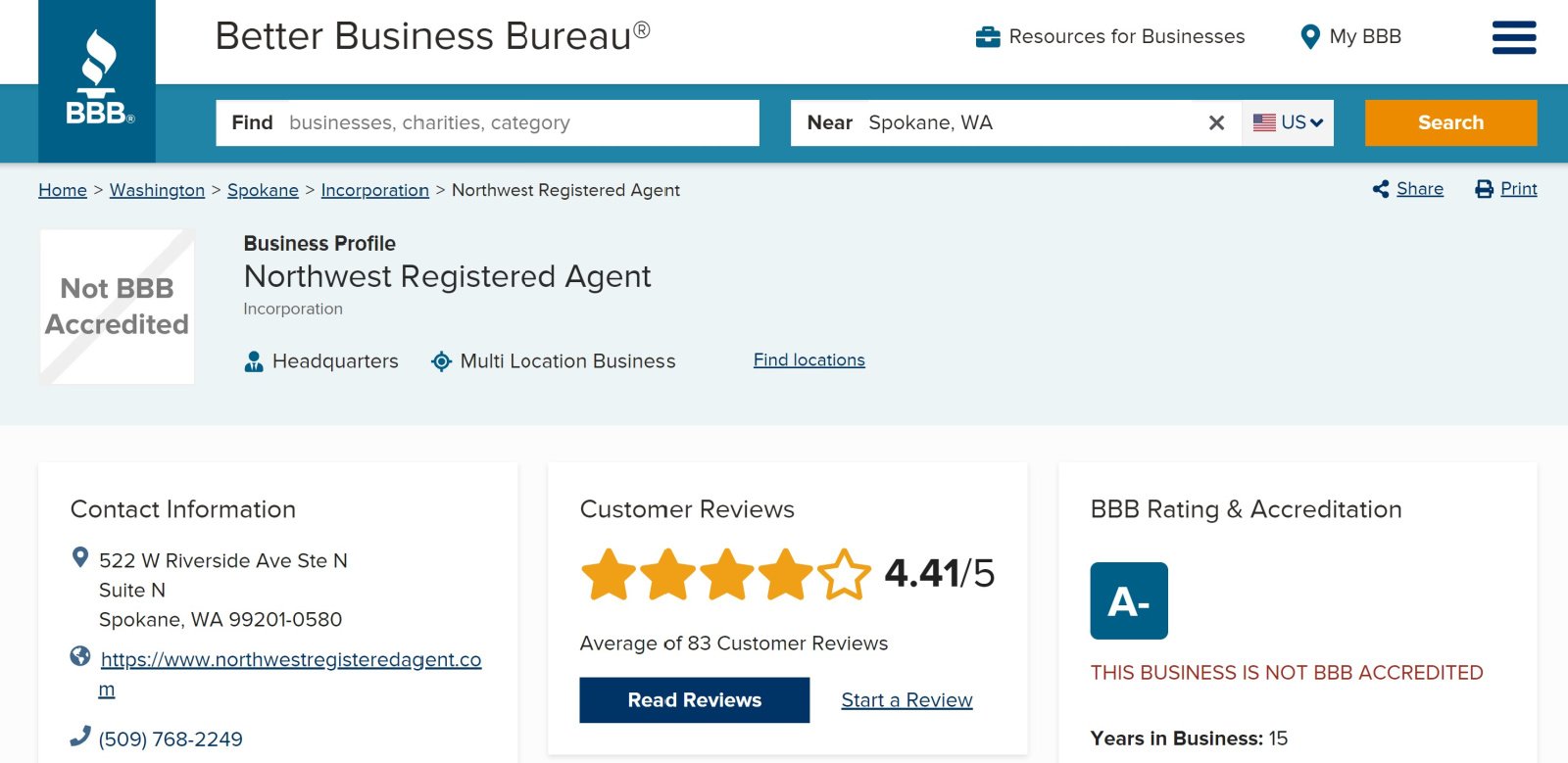

Northwest Registered Agent is a trusted specialist company that provides simple, straightforward, and no-nonsense LLC formation services. A large and experienced customer service staff is another advantage. They are highly rated for their consistency in quality in all aspects.

Northwest Registered Agent BBB reviews

Online ordering of an LLC is easy. There are no hidden fees, upselling or unnecessary partners. The terms of their use are clearly and easily understood. We liked the way Northwest Registered Agent’s website explained the whole process.

The service team at Northwest Registered Agents, also known as “Corporate guides,” is responsive and knowledgeable and can help with any issue related to LLC formations. You will find many helpful articles on the company’s website explaining the legal requirements and nuances of forming a limited liability company.

Excellent turnaround times

Northwest Registered Agent offers excellent turnaround times for LLC formations across all states. All orders come with the same-day filing by default. Northwest Registered Agent consistently ranks amongst the fastest services when we compared their advertised times with those of other competitors.

Northwest Registered Agent can provide all its services in-house, unlike other competitors. This guarantees consistent quality and reliability and protects customers’ privacy and data security.

What Northwest Registered Agents could do better

Their pricing is the only problem. Customers have the option of a flexible package paid up-front, or a fixed package paid in twelve equal installments. Plus a year of registered agent service, a basic formation costs $225.

We believe that Northwest Registered Agents is an excellent choice for anyone looking for a trusted and established partner.

2. Incfile

Incfile is a leading business formation service that allows you to register multiple entity types, manage your accounting, and help you navigate the entrepreneurial journey. Incfile offers many services, including bookkeeping, registered agent services, and business license searches. You can choose one of the three pricing plans available and get your business started today. Visit our Incfile review for more information.

Incfile is our top recommendation for getting your business started. Incfile is an excellent service for any type of business, whether an LLC or a corporation. However, Incfile is not as good in web development services. You’ll find everything you need to start your own small business with the help of its bookkeeping and entrepreneurship services.

Comparing Incfile with The Best Business Formation Services

Incfile is a top-rated business formation service. Incfile allows business owners to form limited liability companies (LLCs), corporations, S-corporations, and nonprofits. You can also access a variety of add-ons, including registered agent services and bookkeeping services. Its add-ons can be expensive and do not offer business website features. ZenBusiness, LegalZoom, and Inc Authority are all great options for business formation.

Incfile’s Strengths and Weaknesses

Strengths

Many Entity Types: Incfile can be used by business owners to incorporate LLCs and C-corporations and S-corporations and nonprofits.

If owners of businesses are splitting ownership equally, they can create member-managed LLCs. Incfile allows you to create a domestic LLC if you need an LLC to operate in your state. For LLCs operating in other states than the state where they were formed, foreign LLCs are possible.

Incfile allows users to create managed-managed LLCs if their partners wish to remain passive. Users can also form single-member LLCs with only one owner. Multi-member LLCs can protect each member’s rights in case of death or disagreement. Incfile also helps business owners to form series LLCs and restricted LLCs. Anonymous LLCs can also be formed. L3Cs can also be created.

S-corporations can be used to save taxes, protect personal assets and allow for easy transfer of ownership. Users can form C-corporations to obtain limited liability, issue stock, and transfer ownership. This will enable them to separate their existence from their owners.

Incfile can register all types of nonprofits, in addition to corporations and LLCs. These include foundations, professional and trade organizations, public charities foundations, and social advocacy organizations. Incfile users may consist of schools, churches, museums, and hospitals, as well as homeless shelters and food banks.

Incfile offers bookkeeping services at a very affordable monthly rate. Monthly reports, bookkeeping software, and a professional bookkeeper are available to users. A small business accountant can offer a tax consultation.

Incfile allows users to match expenses with accounting and bookkeeping and track transactions. Incfile reconciles transactions from credit card accounts as well as business bank accounts. It prepares, reviews, and files tax returns to ensure that every LLC, S-corporation, or C-corporation meets government filing requirements.

Incfile assists business owners in identifying and paying payroll taxes. Sign up for the Incfile business accounting service to get unlimited tax consultations, prepare your business tax returns, manage your mobile account, and kick off a call with your client.

Incfile’s Entrepreneur Resources: It is clear that Incfile’s creators care deeply about entrepreneurs. They offer business formation and other services related to small businesses. However, they also provide many helpful resources. They offer,

- A free guide to starting a business

- Business tools and downloads

- A Start and Run a Business Checklist

- An informative blog

Download the business startup guide to learn how prepared you are to start your business. The guide will teach readers how to measure success in business, marketing and identity, planning and funding, taxes, forms and licenses, and taxes. It also explains how to develop your business idea and the legalities for starting a business.

Incfile provides many entrepreneurial resources, including guides to help you start an Amazon business or a consulting company and information on how to run a food truck, nonprofit, or nonprofit. You can also find guides on how to break down different types of business entities and which states they are best registered in. You can also learn more about registered agents and small business tools.

Incfile’s Weaknesses

Some add-ons are expensive: Although some Incfile services, such as bookkeeping or registered agent services, are reasonably priced, others are quite costly. Incfile charges $95 for annual reports, Articles of Amendment, and Articles of Dissolution. When these fees are combined, they add up quickly, so be sure to choose your add-ons carefully.

Incfile does not offer website assistance. This is a significant disadvantage compared to other business formation services. There are also marketing packages that include a web designer to improve users’ online presence. This is an important feature that you should consider if you are looking for outside assistance with web development or another service for business formation.

Incfile Pricing and Options

Incfile can be broken down into three pricing plans. The price of each project will vary depending on the state you live in and your business type. First, users will choose between LLC, S-corporation, or C-corporation. Next, they will select a nonprofit. Next, users will select the state of formation.

Incfile Silver is entirely free and requires no state filing fees. Incfile Silver includes core features such as unlimited name searches, filing, preparing articles of organization, and one year of registered agents services.

Incfile Gold is available for $149 and includes state filing fees. This plan includes more features, including those listed below.

- Banking resolution

- Form 2553 of the IRS

- Number for EIN business tax

- Operating agreement

- Consultation on taxation for business

- Bank account for business

- Unlimited phone and email support

- Online access dashboard

- Lifetime company alerts

This plan includes everything in Silver and Gold, plus business email, domain names, expedited filing, and business contract templates. Incfile Platinum includes all of the features of the service. The one-time fee is $299, plus any state filing fees.

Incfile provides many other services, in addition to business formation plans.

Incfile Registered Agent Services

Registering a business with Incfile gives users one year of free registered agent services. Users must pay $119 annually to renew the service after year 1.

A registered agent is required for all corporations and LLCs. The registered agent at Incfile can receive documents and legal proceedings on behalf of your company.

A registered agent is a person who has a physical presence in your state. It will also have a registered address. This address will allow the state government to contact you with any required annual reports, notices, litigation or franchise tax forms, and other tax and legal correspondence.

All information, documentation, and legal correspondence are automatically sent to the users. Users are automatically notified by SMS or email when business documents are received. The service also includes an online dashboard that allows users to access their information.

Incfile Annual Report

Incfile allows users to file their annual reports for $99 plus any state fees. Annual reports provide information to the state about a company’s activities in the previous year. The state also receives updates on business and ownership changes.

Incfile allows users to file reports that include the purpose of the business, authorized signatories for registered agents, and the number of shares issued by the company. Incfile can help users create executive summary reports, risk and opportunity reports, financial forecasts and projections reports, and financial forecast and projection reports.

Incfile Foreign Qualification

Foreign qualification is required for business owners who want to conduct business in another country. This is often required when your business expands or has branches in more than one state. Incfile helps business owners to obtain a Certificate of Authority for doing business in other states than their home state.

Incfile is a service that allows business owners to obtain a Certificate of Authority from their state of origin. They also pay the appropriate state fees and file the relevant documents. This service is available for $149 plus applicable state fees.

Incfile Certificate of Good Standing

Business owners can use a Certificate of Good Standing to file taxes, renew licenses and get loans. This certificate is issued by the secretary of state and serves as proof of your business entity. Incfile can help you get this certificate for $49 plus the state fees.

Incfile EIN/Tax ID Number

Businesses use tax ID numbers to establish credit, pay employees wages, open business bank accounts, and file tax returns. Incfile can help you apply for a tax ID number online. Incfile can handle all interactions with IRS and set up this in a matter of hours.

Incfile Gold and Platinum plans include this service. If you wish to purchase it separately, it costs $70 plus any state fees.

Incfile Business License Search

Businesses must have the appropriate business licenses to avoid penalties and fines from local and state governments. Examples of license requirements include businesses that serve alcohol or food or those that build structures. You may also need to designate street parking.

This package will assign a licensed expert to help users identify the required permits and licenses at all levels, including federal, municipal, state, county, and state. The user will then be informed about fees and supporting documents, as well as filing instructions. The licensing expert will then provide the necessary access and license applications.

Incfile Business Taxes

Incfile helps users file taxes by offering bookkeeping and business accounting services. It handles tax preparation, reconciliation, transactions, and tax filing for its users. The service begins with a kick-off call for new clients to discuss the available services and ensure that the user’s account has been correctly set up.

Access to mobile-friendly bookkeeping software is available. Users also have unlimited access to accountants for tax-related questions or IRS notices. Incfile updates its bookkeeping and provides financial reports every quarter. Incfile files federal and state tax returns. Incfile also handles personal 1040 tax returns.

Incfile Fictitious Name

FBN (fictitious business name) refers to a business operated under a name other than the company’s business name. This is often used by business owners who have multiple locations or sell different products.

You can search for fictitious names available and register them with the Secretary of State using Incfile. FBN pricing is determined by the type of entity, state of formation, and service state. For your exact pricing details, please fill out the form at Incfile.

Incfile Amendment

This service provides users with articles of amendment. This is used to alter a business address, declared business activities, authorized shares issued, and removal or addition members, officers, directors. When a company’s articles need to be changed, reports of amendment can be filed. The service is $99 plus applicable state fees.

Incfile Dissolution

A business must file an article to dissolve with the state if it wants to dissolve. To file it, your company must be in good standing. Incfile will handle this process for you. Incfile charges $149 plus any state fees.

Incfile Change of Registered agent

Sometimes your business may need to change its registered agent. Failure to notify the state could result in heavy fines and penalties. You will need to fill out a Change in Registered Agent form and pay the processing fee. Incfile can handle this for you by paying $49 plus any state fees.

Incfile File S Corp Tax Election

S Corporation Tax Election Form 2553 is a tool LLCs can use to reduce their tax burden. You can file this form yourself by visiting the IRS website. Navigate to the S Corporation Tax Election section, download form 2553, complete it, and return it to IRS. For specific pricing information, please enter your business details on Incfile’s website.

3. ZenBusiness

ZenBusiness impressed us with its great value, excellent customer reviews, easy formation process, and ability to create LLCs in a matter of days, even during peak season. We are confident in recommending ZenBusiness to any person looking to create an LLC.

ZenBusiness provides the most comprehensive and competitive business entity creation services based on our thorough review of over a dozen formation firms.

ZenBusiness offers three pricing options to create limited liability companies. The cheapest bundle costs $49. This bundle also includes all the services that we consider necessary for a complete LLC formation.

You get not only the filing and document preparation but also an operating agreement and an employer identification number (EIN) for your company.

In all 50 states, a registered agent must be appointed. An operating agreement is essential to safeguard your personal and business assets. ZenBusiness offers all these services at a fraction of the cost of other companies who charge more for a filing.

ZenBusiness’s higher-tier packages, unlike many others, include services that we consider legitimately valuable, such as an annual compliance filing and a bank resolution. We also recommend digital services like setting up a website for your business and email. All three packages from ZenBusiness are highly recommended.

Customers rate ZenBusiness 4.8/5 on Trustpilot

ZenBusiness is a highly-recommended LLC formation service. With over 5,750 user reviews, they have a Trustpilot rating of 4.8/5. ZenBusiness customers seem pleased at the ease of the LLC formation process and the speed with which their LLC was set up with the state.

ZenBusiness’s ability to establish a reputation is impressive, mainly because it was just founded in 2015.

ZenBusiness’s website is easy to understand and laid out clean, simple, and transparent. All the necessary steps to create an LLC are explained to users. ZenBusiness’s dashboard allows you to keep track of the status of your filings once you have placed an order.

ZenBusiness also offers several helpful articles that explain the many aspects involved in setting up a new business entity.

Where ZenBusiness could be improved

ZenBusiness is an excellent LLC formation service. They performed well in all five ranking categories. We found no problems with their LLC formation service. We recommend them as a nationwide incorporator.

We found that the only problem was with their business website services. Most business owners will benefit from using dedicated web hosting services.

4. Swyft Filings

Swyft Filings has a high rating for its LLC formation service. They offer a flexible and affordable pricing model, has reasonable turnaround times, and responsive customer service. Swyft Filings is a relatively new company in this field, but they have accumulated many satisfied customers.

They do not offer registered agent services as part of their packages. However, they will refer customers to third-party providers.

Flexible pricing, fast processing

Swyft Filings’ unique selling point is their ability to offer a wide range of add-on services and products that allow customers to personalize their service packages. You can add almost any item to the lower-priced boxes by adding it individually. Swyft Filings’ pricing falls somewhere in the middle.

Swyft Filings’s most affordable package, at $49, is also the most competitively priced. However, it does not include the essentials we value, such as an operating contract template or registered agent service. However, they have many other valuable freebies such as an online domain name (URL), registration for one year, and a host of other helpful freebies.

Swyft Filings is not the fastest provider, but it offers quicker processing times than the rest. This allows the process to take only a few days. Customers can choose expedited filing for an additional fee.

Excellent customer reviews

Swyft Filings, despite being a young company, has received an impressive number of positive reviews from satisfied customers. Swyft Filings has over 4,000 reviews on Trustpilot. The company’s simplicity, speed, and friendly support staff are all praised.

Swyft Filings has an explicit refund policy, unlike many other services. Swyft Filing will refund any fees incurred if they make an error in filing your LLC paperwork with the state authorities.

Where Swyft Filings could be improved

Swyft Filings tried to sell unnecessary services from their partner companies during checkout. They rely heavily upon third-party partner companies. This was something we found unacceptable. Companies that employ their staff prefer us.

5. Rocket Lawyer

Rocket Lawyer is a trusted name in online legal services. Rocket Lawyer offers a range of legal and compliance services and an online LLC formation service for both members and nonmembers. Rocket Lawyer is an excellent option for people interested in Rocket Lawyer’s other, specialized services such as their online attorney consultation and legal document templates database.

Well-reviewed and established

Rocket Lawyer has been around for over a decade and has millions of users. They are trusted and have received many positive reviews online from customers via Trustpilot (where they are rated at 4.6/5 with over 3,100 reviews). This gives them a lot of experience in online legal aid.

RocketLawyer, however, is not a limited liability company formation service. Many of the customer feedback pieces don’t mention LLC formations.

Prices and turnaround times

Customers have two options: they can sign up for a $39.99 monthly subscription or purchase individual services (e.g., document filing for $99.99).

RocketLawyer’s pricing leads to a high total cost for a complete formation (i.e., A formation plus an operating agreement and a registered agent service.

However, if you are planning on using other services, the monthly option may be worth considering.

RocketLawyer membership includes one free LLC, unlimited access to modified legal documents/templates, and a discount on the company’s registered agent service. (Read more in our Rocket Lawyer review).

Rocket Lawyer’s turnaround time is not the fastest, but they are relatively fast, with an average processing time of about one week in most states. You can choose to expedite the filing if you need it. This will ensure that you receive a response as soon as possible.

You will be provided with estimated turnaround times for standard and expedited orders during the sign-up process. These times may vary depending on your state and file type.

Rocket Lawyer: Where Rocket Lawyer could improve

Rocket Lawyer’s subscription does not include all the essentials for basic LLC formation. Rocket Lawyer’s registered agent service will require you to pay an annual fee, although members receive a discount. A subscription is only for the first LLC you create. All subsequent LLCs will require a fee.

Rocket Lawyer also had many customers leave reviews online expressing surprise at being charged their credit cards. Cancel your Rocket Lawyers subscription from your account dashboard to avoid any unwanted charges. Rocket Lawyers’ subscription automatically renews.

6. Inc Authority

Inc Authority has been in business for over 30 years and is one of the most trusted LLC formation companies. Inc Authority is unique because they offer a fundamental LLC formation service for free (excluding state fees).

Their higher-tier service tiers are expensive and have slow turnaround times.

Free Basic LLC Formation

Inc Authority’s basic package is free and includes essential documents filing and business name availability checks. However, it does not involve operating agreement drafting, which we consider vital.

This package also includes a year of free registration as an agent, otherwise $99 per year. Inc Authority is a good option if you’re looking for an easy LLC filing system.

Premium packages from the company are available at $399, $499, and $799. We don’t recommend them as they are not of high value.

Excellent customer feedback

Inc Authority has received overwhelmingly positive feedback from users on major review sites. With over 5,000 reviews, they are rated 4.8/5 by Trustpilot and 4.6/5 by Google. Most customers have positive experiences with Inc Authority in forming limited liability companies. Many customers praise Inc Authority’s professionalism as well as its customer service.

Where Inc Authority could be improved

Inc Authority is one of the LLC formation companies that appears to delay formation orders internally to “encourage” users to pay an extra filing fee for expedited service. Customers who pay $49 more will see their orders moved to the top of Inc Authority’s queue. These practices are unacceptable.

This expedited order processing is not the same as expedited filing services offered by certain state governments (which will speed up the process with the state rather than your particular service provider).

Inc Authority will try to sell you a lot of services during checkout. These services and products, such as physical Ownership Certificates, are not necessary for new businesses. They can be avoided.

7. BetterLegal

BetterLegal, a Texas-based firm specializing in LLC formations, is relatively small and young. Their filing services are offered in a single package for $299. BetterLegal claims a two-day turnaround and is well received by customers. However, their rigid pricing model and unnecessary services in their single package make them less valuable than other filing services.

Registered agent service with a fast turnaround and reasonable prices

BetterLegal claims a two-day turnaround on all formations. They do not separate customers into priority groups like many competitors. All orders are submitted on the same day without additional charges to expedite your order.

Many customers review this up, often mentioning the speed of BetterLegal LLC formations. We appreciate the fact that BetterLegal is transparent about its service speed.

BetterLegal offers the lowest cost registered agent service. Their cost is considerably lower than average among all the services we reviewed, at $90 per annum.

Because all registered agent services cost recurring fees, even small savings can add up. BetterLegal offers registered agent services in collaboration with third parties.

Positive Customer Reviews

BetterLegal may be a small company, but they still manage to get many positive reviews. Their reviews are overwhelmingly positive. Customers appreciated the quick and easy formation process. With around 200 reviews, they currently have a Trustpilot rating of 4.8/5. They have been accredited by the BBB and are highly rated.

We believe BetterLegal could do better.

BetterLegal’s rigid pricing structure and high costs are the main downsides. While other services allow customers to choose which services they require, BetterLegal offers only one package at $299.

This package does not include a registered agent service. This increases the cost of a full-formed formation even more. Some of the included services are unnecessary. We don’t think that small business owners should pay someone else to get a federal tax ID number.

Key Factors in Our Reviews

When ranking and reviewing formation companies, we use five key elements. These factors may not all be equally important, but they are all important.

Here is a quick overview of each to help you choose the best value formation service and explain our scoring process.

#1. LLC Formation Pricing and Packages

When choosing an LLC formation service, pricing is the most important consideration. We want the services we review to add value to your startup and not break the bank. When calculating our ranking scores, pricing is given a higher weight.

Prices for LLC formation services vary greatly. Some companies will file your Articles of Organization for as low as $50 or even free. Others charge hundreds of dollars for a variety of additional services and products.

We consider more than just the price of a service package when evaluating and ranking them. A more expensive package may still be worth it if you have specialized needs.

#2. LLC Turnaround Time

We understand that time is valuable and expect all the services we review to file your LLC registration paperwork with the appropriate authorities as quickly as possible. Online services are unnecessary if you can complete your LLC formation quicker than yourself.

We believe turnaround time is just as important as the price of service. For this reason, when we calculate our final ranking score.

After they have filed your documents, LLC formation services do not have complete control over its time to create your company. The state government agencies process your Articles of Organization. However, some states allow for expedited filing with an additional fee.

However, there are still ways that formation services can add value to your LLC’s formation. For example, they can process orders internally the same day or use their network of physical offices to file paperwork in person.

Also, formation services should do everything possible to avoid filing errors. These can delay or set you back weeks and could even cause delays in other formalities, such as opening a bank account for your business.

#3. Customer satisfaction

There is no better way to find out about a particular formation service than from people who have used it. We value track records and consider feedback and reviews from previous customers on sites like Trustpilot or Yelp.

Is it possible to determine if a company offers high-quality customer service or if they just claim to? We can find out by looking at customer reviews. Reviewing a service can give us a better idea of its performance in real life.

#4. Easy of use

The online formation of an LLC should be easy. Websites that make it easy for users to file their LLC filings online should be ideal. It is also important for small business owners to quickly find concise and precise answers to common questions.

We found that many of the best services have hundreds or even thousands of pages detailing everything you need to know about setting up an LLC. These articles can answer questions like:

A good service will give you all the information you need to make informed decisions from the beginning.

Our ratings are based on the ease of use, its terms (costs and recurring payments, cancellations, etc.) Their web materials are informative and precise.

#5. Support and help

No matter how well-designed a website may be, chances are you’ll have questions or issues that can’t be solved automatically.

It is crucial to reach someone if you find yourself in an unplanned situation quickly. Even better is if they have the knowledge and training to assist you with any issues.

This is particularly true in the formation industry, where a late filing or a clerical mistake could cause your plans to be delayed by weeks or even months.

Many companies on our list offer recurring services such as annual reports filing and registered agent services as part of their formation packages. It is crucial to resolve any problems with these services quickly. This is important for maintaining your company’s good standing in the eyes of the federal and state governments.

When evaluating the customer support and help options for an LLC formation company, we consider many factors. We think things like the availability of their staff, their working hours or if they are available at weekends, and their contact methods (phones, email, chat, etc.). Also, we consider the customer’s experience as evidenced in feedback.

Five Must-Know Tips for Using an LLC Service

The five metrics mentioned above are the best way to decide on an LLC formation company. However, we’d like to offer a few more tips that we think all new business owners and LLC-formation-seekers will find when starting their LLC.

1. You must distinguish between the “essentials” and the “nice-to-have.”

Certain formation services are essential. Your business will not be officially registered if you don’t file your Articles of Organization with relevant state authorities.

Even if you are a registered agent, it is legally required that you have one. Although not technically essential, some documents, like an Operating Agreement, can be considered necessary.

These are the things you must have. Depending on the size of your business and your industry, you may need to have additional must-haves. You might ask your formation company to handle your annual reports or search for the necessary business licenses.

Many LLC formation companies sell both “must-have” and “nice to have,” but they don’t distinguish between them.

Nearly every service we reviewed offers some type of customized office gear package. Many items, such as corporate seals, binders, and record books, are included.

These items are nice and all, but they are not necessary. Reviews and third-party consultations (e.g., Third-party consultations and reviews (e.g., tax consultations or insurance reviews) should be placed in the same category.

When you review package prices, make sure to separate the necessary services from the “nice-to-have” fluff. You might be surprised at how many LLC formation packages contain little substance.

2. Be aware of recurring payments

It can be challenging to keep track of all the services included in an LLC formation package. It is important to note that many of the services related to formation, such as a registered agent or annual report filing, and compliance services are billed ongoing.

However, we are not saying you should avoid signing up for recurring services. Many of these services are very useful. You should read the terms of any package you sign up for to ensure you know when you will be charged, what you have to pay, and what you can do to cancel services that you don’t need.

While some LLC formation companies are upfront about recurring payments, others may be less open. Our reviews have highlighted both the good and bad, and we gave high marks to transparent businesses and low marks to opaque ones.

3. Find out if your business will benefit from an S-Corporation filing

The IRS assigns the S-corp status as a tax status. Eligible are both standard corporations (C-corporations) and LLCs.

Designating yourself an S-corp will help you save money on your payroll taxes, and it can also confer tax benefits. A business tax expert can help you determine whether S-corp status is right for your business.

However, it is in your best interest to decide whether you want to elect S-corps before choosing your LLC service provider. Some service providers will offer to file Form 2553 (Scorp election) free of charge with their formation packages. Others will charge for this additional service. Some companies do not provide this service.

It’s easier to file all paperwork in one go when you form your LLC than to have to return to file more paperwork later.

It’s a bright idea to determine whether you would like to file for a Scorp election before filing. This is one less thing you have to do later and may influence your choice of LLC formation service provider.

4. Learn the difference between state expedited filing and internal expedited filing

There are two types of “expedited services” when it comes to forming an LLC—first, state-expedited service. Some states’ Secretary-of-State offices allow filers to “jump ahead” and create an LLC for their company for an additional fee. This can reduce waiting times from 2-4 weeks to 2-4 days.

Many incorporation services offer the possibility to request state-expedited services. The service is paid for an additional fee and then sent to the state. It’s that simple.

Some LLC services offer the possibility to pay for expedited filing. This has nothing to do with the state. Internal expediting simply means that your application is being prioritized within the company’s system. This means that your application will be processed faster but won’t move more quickly than normal once it is there.

Many services can provide quick, sometimes same-day, internal processing for those who need it.

5. Is it required that you use their registered agent services by a company?

We consider a registered agent service essential when forming new LLCs. Every LLC or other business entity operating in the US requires a registered agent. Although you can serve as your registered agents, there are many good reasons to do so.

Nearly all of the services we looked at offered a registered agent service for new LLC owners. This service is provided by some companies in-house while others outsource it.

Some companies have a registered agent service as a default. A few won’t allow you to opt out. You should ensure that your registered agent service provider has an opt-out option if you have one in mind.

Frequently Asked Questions

What is the best LLC service?

The top-rated LLC formation company that we like for 2023 is Incfile. Their combination of excellent pricing, speedy service, and customer satisfaction is strong.

Which is the most affordable service for forming an LLC?

For those who value affordability, Incfile is the best choice. Their basic LLC formation service is $0 + state filing fees. The basic package includes one year of registered agent service and an operating agreement.

Do I need an attorney to create an LLC?

You don’t have to be an attorney to create an LLC. Although they can accomplish the same task, LLC formation services are usually faster and cheaper. If your LLC formation is complex or unusual, you might need to consult an attorney.

Can I create an LLC online?

You can create an LLC online. Virtually every LLC formation service allows you to complete the whole process online. Depending on which online LLC service you choose and the state in which you’re forming your LLC, you can create your LLC and receive your documents within a matter of hours.

What is the cost of starting an LLC?

It all depends on where you’re forming the LLC. Each state charges a filing fee to establish a new LLC. Although most LLC formation services charge a fee, some companies offer basic online business formations starting at $0 + state fees.

What is an LLC formation service?

LLC formations services specialize in helping new business owners form their LLCs with state authorities. They are familiar with the state bureaucracies to help avoid rejections. We did not review any law firms. They cannot provide legal advice.

Where can I create my LLC online?

ZenBusiness is our top choice when it comes to online LLC formations. Other companies like Northwest Registered Agents or Active Filings also received high marks. For more information, please read our article.

Is online filing officially recognized?

LLC filing services work in partnership with state Secretary of State offices to prepare and file paperwork required for forming a limited liability company. The state will recognize your LLC if it is successful.

What are the advantages of setting up my LLC online?

Online filing eliminates the need to navigate through the bureaucracy of your state and lowers the chance of an error-related rejection. The procedures required to create new LLCs are well-known and can often be completed faster than individual filings.

Jeff Beckley is a business expert, journalist, book author, and founder of the website Best Inc Services. Jeff can be reached at, info@bestincservices.com